Composite Firebird Portfolio Tools

Firebird Tools Video

Composite Firebird Portfolio Tools

Radar Tool

# of Legs

Description

Status

Market Price (Monthly)

Action

Greek Analysis and Why it Matters-1 Page Description

N/A

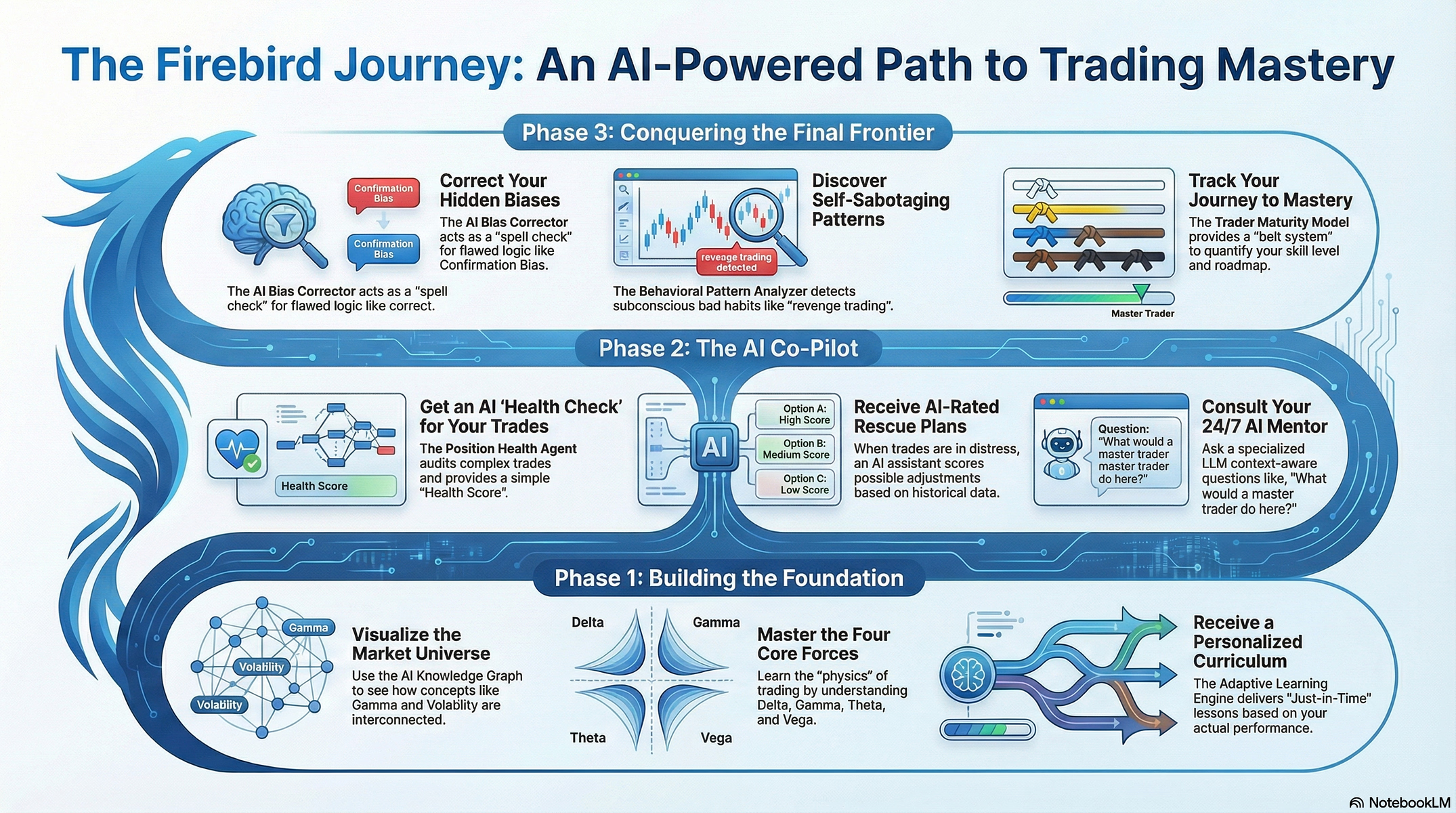

The Firebird "Greek Analysis and Why it Matters" one-page description serves as a critical diagnostic tool that dismantles your active trades into their four-component physics: Velocity (Delta), Acceleration (Gamma), Time (Theta), and Fear (Vega). By isolating the specific "Toxic Greek" responsible for a position's performance, this report moves beyond simple P&L to reveal whether a loss is caused by a wrong directional guess or a hidden bleed from volatility and time decay. Traders utilize this insight to transform risk management from emotional guesswork into a solvable equation, calculating the precise adjustments required to flip negative metrics back to positive or determining the optimal moment to close a winning trade. Consequently, this educational analysis acts as the "operating system" for your portfolio, ensuring you are not just gambling on price movement but are engineering your risk with mathematical precision.

N/A

$10.00

Firebird Portfolio Improvement Engine

N/A

The Firebird Portfolio Improvement Engine acts as an automated performance coach that conducts a forensic "post-mortem" on your trading history to mathematically separate genuine skill from lucky market drift. It identifies specific "Profit Leaks" by detecting expensive habits such as "Premature Ejection" of winners or "Revenge Trading," ensuring you learn the right lessons from every transaction regardless of the immediate P&L result. Beyond mere diagnosis, this "robo-advisor" actively prescribes solutions, scanning the market to suggest specific repair trades—such as buying a Calendar Spread—to fix quantitative flaws like being dangerously "Short Vega". Consequently, this tool transforms your trading from a series of gambles into a business, creating a continuous feedback loop that turns past data into a roadmap for future profitability.

N/A

$10.00

Firebird Hedge Designer

N/A

The Firebird Hedge Designer acts as a structural architect for your portfolio, solving the complex engineering problem of constructing maximum protection for a fixed monthly budget. Using a "Constraint-Based Solver," it iterates through millions of strategy combinations—from standard Puts to complex Ratio Spreads—to build a bespoke defense that meets your specific crash protection criteria. Beyond generic market hedges, this tool scans global assets to identify "Cheaper Beta" opportunities, finding specific cross-asset correlations that offer better protection per dollar than expensive index options. Consequently, these transform hedging from a vague insurance bet into a precise construction project, providing you with a complete lifecycle plan for entering, rolling, and monetizing your defense.

N/A

$10.00

Portfolio Health-1 Page description

N/A

The Firebird Portfolio Health-1 Page Description serves as a comprehensive "State of the Union" audit for your entire account, aggregating disjointed positions to answer the critical question of whether your portfolio is mathematically engineered to survive a market crash. By calculating Beta-Weighted Delta and running Correlation Stress Tests, this report exposes hidden "concentration risks" where seemingly diversified assets might lockstep during a panic, threatening your solvency. It distills these complex metrics into a simple color-coded "Health Score," instantly alerting you if your risk profile has drifted from a balanced "Green Zone" into a fragile "Red Zone",,. Furthermore, it moves beyond mere warnings by providing specific, prescriptive hedge suggestions—such as buying sector-specific puts—to neutralize dangerous exposures and proactively restore your portfolio's structural integrity.

N/A

$10.00

Firebird Portfolio Health Dashboard

N/A

The Firebird Portfolio Health Dashboard acts as a comprehensive "State of the Union" auditor for your entire account, aggregating disjointed positions into a single, actionable "Health Score" that instantly reveals whether your book is balanced or fragile. By running continuous Correlation Stress Tests and Beta-Weighted Delta calculations, this tool exposes hidden "fake diversification" risks where unrelated assets might suddenly lockstep during a market panic, threatening your solvency. Rather than just flagging problems, the dashboard prescribes specific, mathematical cures—such as "Buy Sector-Specific Puts"—to neutralize dangerous exposures and return your portfolio to the "Green Zone". Consequently, this converts complex risk management into a simple, proactive discipline, ensuring your capital is architecturally engineered to survive volatility rather than collapsing under it.